How Nubank Is Revolutionizing Banking with Product-Led Growth

Nubank's PLG success demonstrates that far from product management declining as a career, it's evolving into an even more strategic role. The tendency: Product Managers will become General Managers.

There’s three questions that keep product managers awake at night:

Why do great ideas die in the purgatory of priorities?

How do we balance innovation with regulation?

And is product management evolving or being automated away?

Well, Nubank is a great example to answer these questions. The Brazilian fintech giant has transformed the traditional banking landscape by leveraging the principles of product-driven growth (PLG).

This fintech powerhouse has emerged as a disruptive force in banking, scaling to over 100 million customers and recently securing a banking license in Mexico. But what's most fascinating is how they've positioned product management at the center of their strategy and emerged as one of the top companies developing the next generation of product leaders.

Let's see a quick recap of how Nubank has evolved since 2013 and its different growth stages:

Phase 1: Founding Phase (2013-2016)

→ 2013: Launched with one product (no-fee purple credit card) targeting one pain point (Brazil’s 450% APR credit cards)

→ 2014: Selfie-powered onboarding cuts approval time from 15 days → 5 minutes

→ 2016: Hits 1M users via viral waitlist: “Invite 3 friends → skip the line”

Phase 2: Platform Leap (2017-2020)

→ 2017: NuConta savings account (5M users in 18 months)

→ 2019: Mexico entry via SOFIPO license – 1M cards in 10 months

→ 2020: Berkshire’s $500M bet validates unit economics: $5 CAC vs incumbents’ $150

Phase 3: Hypergrowth (2021-2023)

→ 2021: IPO at $41B. PMs now own P&Ls for product lines

→ 2022: Profitability via “layer cake” monetization (interchange → loans → insurance)

→ 2023: 90M users. Launches in-app telco (eSIMs) – 27% attach rate

Phase 4: Global Bank (2024-2025)

→ 2024: Mexico banking license approved. First product? Payroll accounts for unbanked factory workers

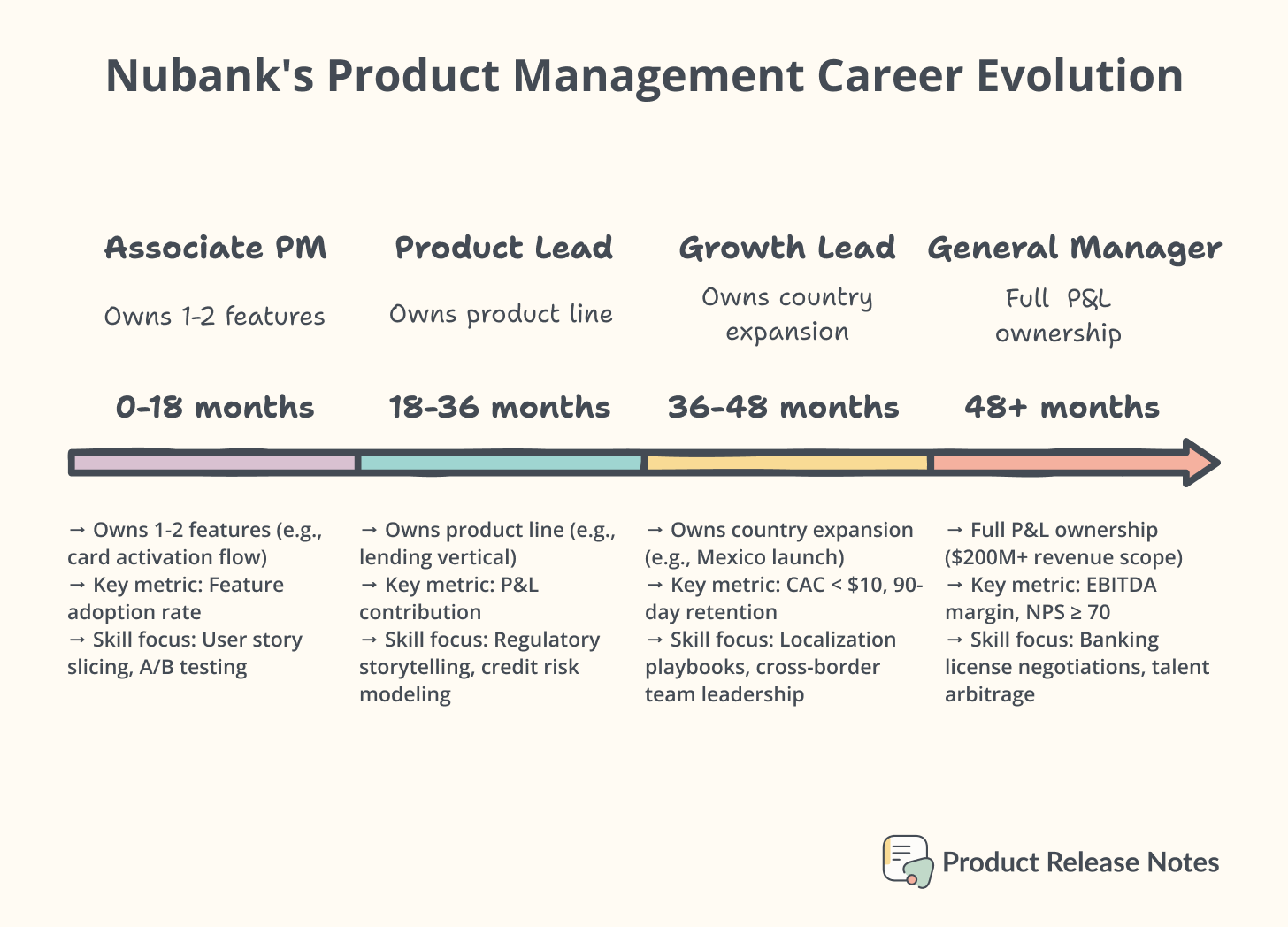

→ 2025: 100M users. PM career path formalized: Associate PM → Growth Lead → Country GM (avg. 3.2 years)

3️⃣ Top Questions About Nubank's Rise

When we look at Nubank's meteoric rise from fintech startup to a full-fledged bank valued at $45 billion at IPO, three questions come to my mind.

1. Why do traditional banks fail at innovation while Nubank thrives?

Traditional banks are often trapped in legacy systems and bureaucratic decision-making. Meanwhile, Nubank has positioned itself as a customer-obsessed organization that puts product at the center of its operation.

Let's break this down into actionable insights:

→ Embrace a digital-first mindset: Nubank launched with a no-fee credit card managed entirely through a mobile app, focusing on solving real customer pain points rather than preserving legacy revenue streams.

→ Build for extreme customer-centricity: Nu Mexico's recent banking license approval will enable them to expand their product portfolio specifically to increase inclusion in a market where only 36% of adults have payroll accounts.

🤯 POV as a Nu user

Compared to other bank apps and legal processes, Nu experience is fiscal process is just outstanding. Their app is easy to set up and use and the benefits of their offerings are clear and straightforward.

Each feature feels thoughtfully designed to enhance user experience, whether it's tracking spending, applying for loans, or managing savings effortlessly. This customer-centric approach is a crucial differentiator that speaks volumes about Nubank's philosophy—prioritizing user needs over traditional banking norms.

More importantly, I didn't have to leave the house to set it all up. No kidding, but now that Nu will be an official bank in my country, I will change it to be my official bank account.

2. What makes Nubank's product organization scale internationally?

Nubank began its international expansion in Mexico in 2019, and recently received banking license approval there - becoming the first Popular Financial Society (SOFIPO) to obtain approval to transform into a bank.

The key components of their expansion strategy:

→ Start with simple, high-impact products: They launched with a no-fee credit card in 2020, then expanded to debit accounts, savings accounts, and personal loans.

→ Build for local needs while maintaining global standards: They've created customizable financing plans tailored to local needs while maintaining their core digital-first approach.

Real-World Snapshot

Nubank's Product Impact

🏦 100M+ customers across Brazil, Mexico, and Colombia

💰 $8 billion in annual revenue (2023)

📱 Reached 10M customers in Mexico with digital-first approach

💳 Provided nearly half of Mexican customers with their first credit card

🌐 Reaching 98% of Mexico's municipalities, including rural areas

3. How is Nubank transforming product managers into business leaders?

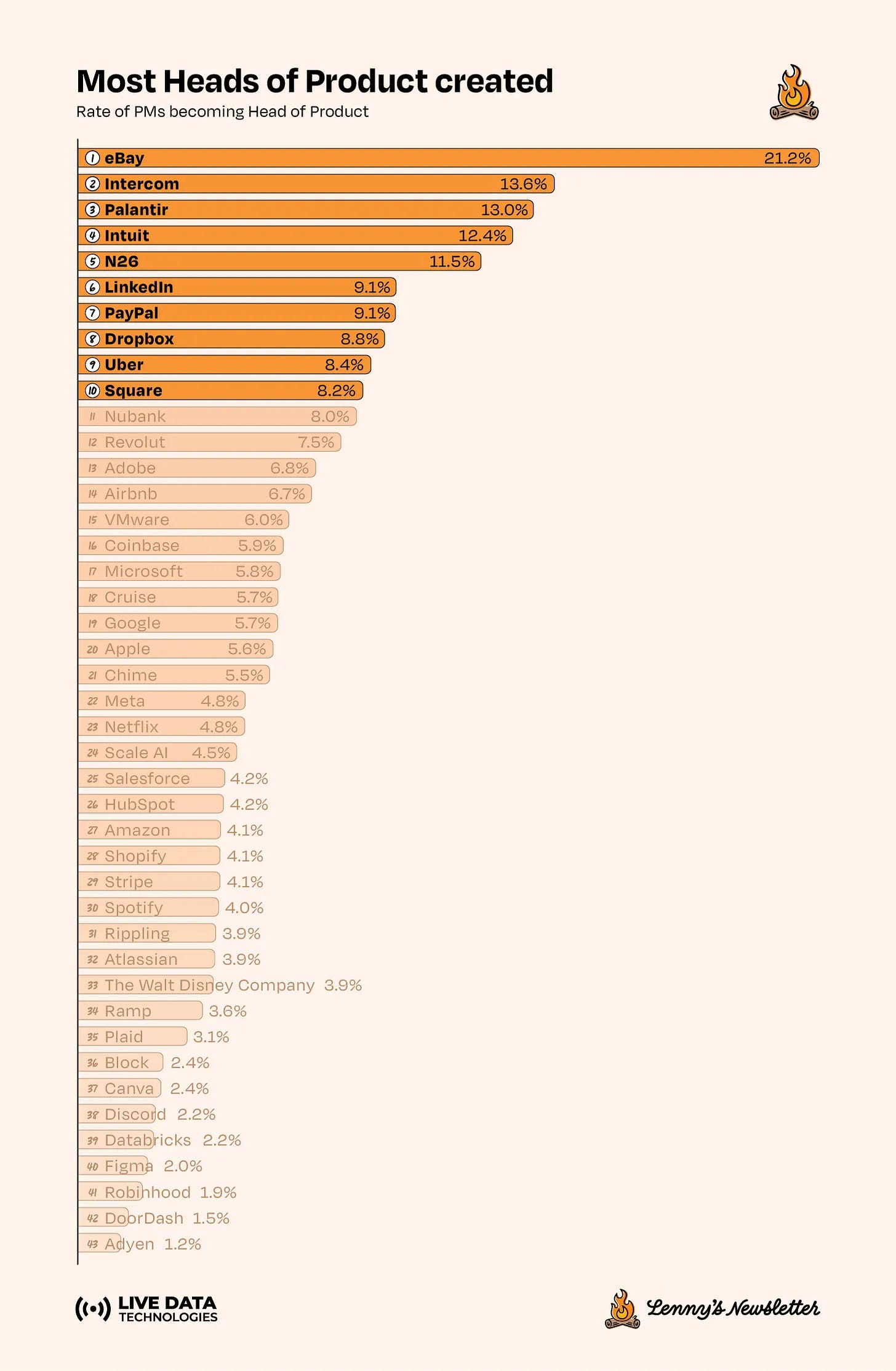

According to Lenny's newsletter, Nubank ranks among the top companies accelerating PM careers and producing successful product leaders. This doesn't happen by accident.

Here's how they approach PM development:

→ Treat PMs as mini-CEOs: Product managers at Nubank own the full business outcome, not just feature delivery, aligning with the industry trend of PMs becoming general managers with P&L responsibility.

→ Focus on rapid growth and promotion: Companies like Nubank, Revolut, and Intercom rank in the top 10 for both internal promotions and external career acceleration for their PMs.

Looking at Lenny's newsletter data, fintech is dominant in developing top product talent - with 5 out of the top 10 companies coming from the financial technology sector. Nubank ranks highly because:

→ They focus on measurable customer outcomes over features

→ PMs get exposure to real business metrics early in their careers

→ Their product org operates with startup speed but enterprise impact

→ Product managers are held accountable for growth outcomes, not just shipping

See more about Lenny's Newsletter research here:

Product Management as a Strategic Leadership Position

What makes fintech companies great PM breeding grounds?

Fintech dominates the rankings of companies that accelerate PM careers - 5 out of the top 10 companies in Lenny's analysis come from the financial technology sector. Companies like Revolut, N26, Plaid, and Nubank are creating the next generation of product leaders because:

They operate in highly regulated environments that teach PMs to navigate complexity

They deal with real money, creating high stakes for product decisions

They must balance growth with risk management and compliance

They often serve underbanked populations, requiring deep customer empathy

How do you build a product organization that scales across countries without losing focus?

Product management has evolved significantly over the past decade. As the Linkedin post from Himanshu Kadam explains,

"Today, the product manager role has evolved into a strategic leadership position with a strong emphasis on customer-centricity and innovation”.

Nubank exemplifies this evolution by:

→ Having product managers drive strategy, not just execution

→ Creating cross-functional teams led by empowered product managers

→ Focusing on customer problems before technological solutions

→ Treating data as a product asset, not just a reporting tool

How to become a general manager as a product leader without losing your technical edge?

The trend toward product managers becoming general managers with P&L responsibility is accelerating. For example, at companies like Nubank product managers are expected to:

→ Track the return on investments for their products

→ Take accountability for the P&L of their products

→ Lead horizontally across a matrix of dependencies

→ Communicate effectively with stakeholders and product team

For example, Nu Mexico recently received banking license approval, paving the way for them to expand their product portfolio and increase financial inclusion in a market where only 36% of adults have a payroll account. This combination of social impact and business growth creates a perfect training ground for product leaders.

If we take a closer look, this is how product management has evolved within Nubank:

What Industry Leaders Are Saying

David Vélez, CEO and founder of Nubank, emphasized how product leadership drives their strategy in Mexico:

"We've already made significant progress in terms of growth, reaching over 10 million customers in the country. We have invested over $1.4 billion in the market, not only to scale our presence but also towards driving innovation and elevating the standards in the local financial sector”.

Lenny’s data insight from INSEAD Business School suggests that fintech companies nurture strong product leaders because the work is essentially on "hard mode" - lots of risk vectors, difficult regulatory stakeholders, and complex tradeoffs. So much fun! 😅

PM Self-Check ✔︎

Are You Developing General Manager Skills?

□ Do you understand your product's contribution to overall business financials?

□ Can you articulate your product's unit economics and cost structure?

□ Are you tracking both leading and lagging indicators for your product?

□ Do you regularly communicate with finance, legal, and compliance teams?

□ Have you taken ownership of a P&L component, however small?

□ Are you developing skills in stakeholder management beyond your direct team?

The transformation of product managers into general managers isn't unique to Nubank. As Amy Mitchell notes, this requires a broader skill set than traditional product management:

"Product managers are expected to track the return on investments. Product managers are accountable for the P&L of their products".

If you want to know more about these product management tendencies feel free to check Amy’s article here:

Final Thoughts

The Nubank story demonstrates that far from product management declining as a career, it's evolving into an even more strategic role. In an industry as complex and regulated as banking, placing product at the center of the organization has enabled Nubank to scale to 100 million customers while expanding internationally.

Remember: The best product managers don't just ship features - they ship business outcomes. Nubank's success shows that when product managers truly own the business impact of their decisions, both customers and careers flourish.

If you want to know more about Nubank’s story here’s a great article from Product Growth.

Looking ahead, the role of product managers is set to evolve even further! 🔺 AI and automation are changing the way products are developed and managed, requiring us to be adaptable and open to learning new skills.

Continuous education and professional development will play a key role in ensuring that PMs remain at the forefront of innovation.

What do you think of Nubank’s success? Or the evolution of PM career? Would you like to see more posts on business case studies? Let me know in the comments. 👇

I enjoyed your insights on Nubank's product process. You connected the dots well, such as FinTech product leadership skills and product managers as a general manager.

Thank you for the shoutout!

I like Nu’s services and App, and you can see their focus on data-based growth decisions really works. I also see more similarities in PM and GM work more than a regular Manager or Agile stuff.