What Happened To Polywork? An Eye-opening Story Of Fail Growth

From LinkedIn challenger to shutdown: Polywork’s journey offers crucial lessons for product managers. Dive into this postmortem analysis to uncover valuable insights.

Polywork, the professional network that took on LinkedIn, has closed its doors on January 31, 2025. The platform caught the attention of many professionals, including myself, when it was launched back in 2022 at Product Hunt and won a Golden Kitty Award.

For those unfamiliar with it, the platform aimed to redefine the way professionals showcase their multifaceted careers and skills and facilitate more meaningful work connections.

As product managers, we are always looking for lessons we can learn from both successes and failures in our industry. To somewhat honor the spirit of this product, let's dissect what went wrong in a handy postmortem analysis that we can use as valuable lessons and insights to apply (or avoid!) in our own products. 👇

Polywork’s Journey From Beginning to End

Let’s quickly recap Polywork’s journey to go deeper into the analysis.

⦿ 2021

Polywork launches with the vision of being a LinkedIn alternative, allowing users to showcase their multifaceted professional lives. Polywork burst onto the scene in 2021 with a bold vision:

Create a professional network that went beyond the traditional resume format.

Founded by Peter Johnston, the platform was intended to be a refreshing alternative to LinkedIn's often stuffy, one-dimensional profiles.

Key features that set Polywork apart:

🔼 Customizable profile pages that showcased both personal and professional achievements

🔼 A "timeline" feature that allowed users to highlight their diverse skills and experiences

🔼 Collaboration opportunities through "space" creation for projects and interests

⦿ 2022

The idea resonated with many, including some big names in tech. Polywork managed to secure an impressive $13 million in funding, with backers including the Collison brothers of Stripe fame, Reddit co-founder Alexis Ohanian, and product guru Elad Gil.

This funding underscored confidence in its potential to disrupt LinkedIn’s dominance.

⦿ 2023

🎯 The Objective: Breaking the Network Effect

Despite its innovative approach and strong financial backing, Polywork faced an uphill battle from the start. The professional networking space is notoriously difficult to crack, thanks in large part to the powerful network effect enjoyed by established players like LinkedIn.

🫢 Personally, I'm not a big fan of LinkedIn. So it was refreshing that they had a new competitor. But it turns out that LinkedIn is kind of a “necessary evil” because of the magnitude size of its vast network.

The cold, hard truth about social networks:

🏃🏻♀️➡️ Users go where other users are

👨🏻💻 Content creators go where the audience is

🤑 Advertisers go where the users and content are

Polywork and its toughest competitor: LinkedIn

Both Polywork and LinkedIn have in common:

⬌ Past and current jobs

⬌ Relevant projects

⬌ Skills obtained

⬌ Certifications

⬌ Scholarships

But LinkedIn… Well, it’s LinkedIn

Because LinkedIn has a longer history and a more established professional networking platform, connections have a more significant and lasting impact on professional reputation:

Presence of current and former bosses

Colleagues from current and past companies

Alumni from educational institutions

Potential future employers

Breaking this cycle requires not just a great product, but also impeccable timing, execution, and maybe a bit of luck. 🤷♀️

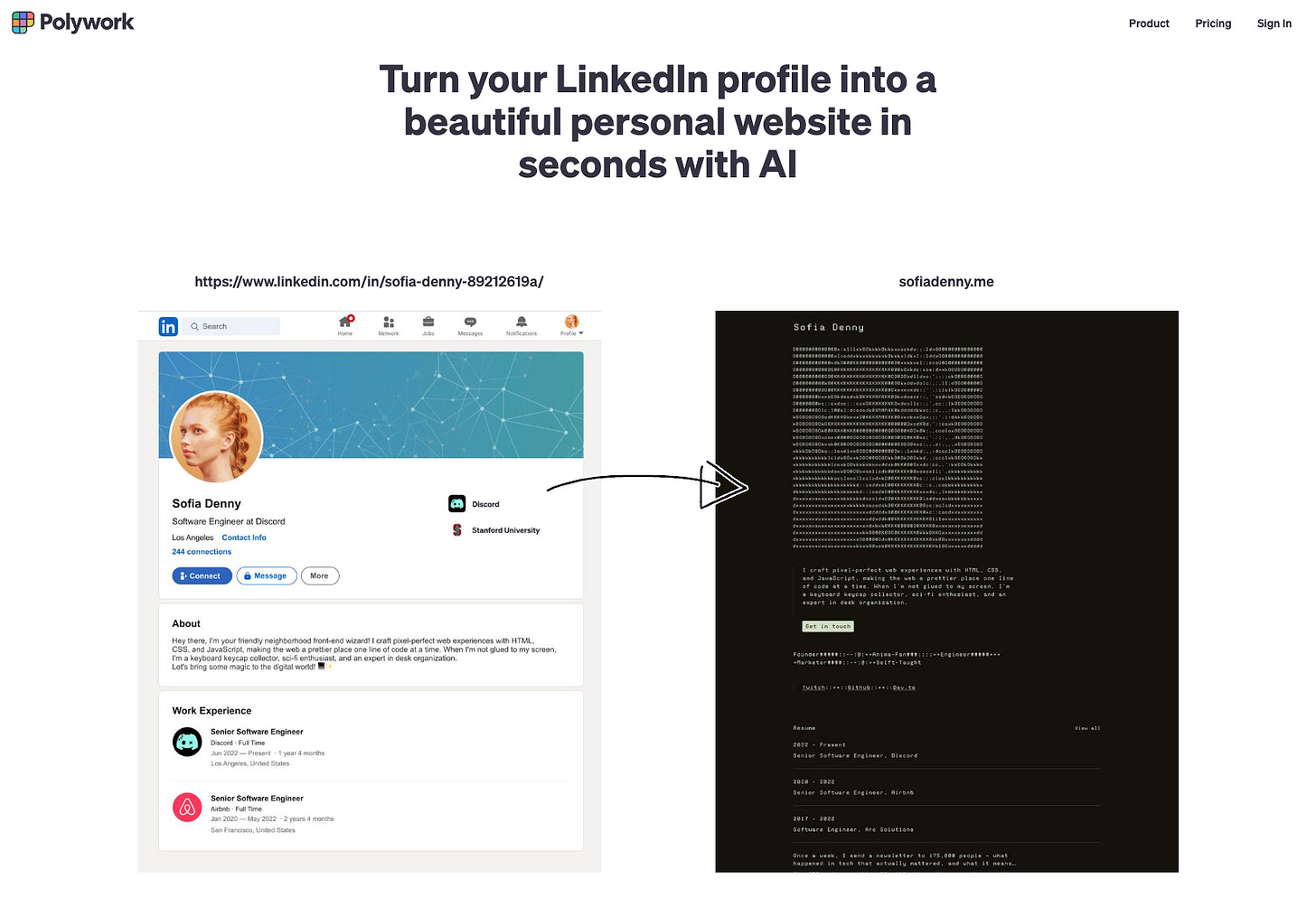

⤵️ The Pivot: From Social Network to Website Builder

When user growth stalled and the initial hype faded, Polywork made a strategic shift. At the end of 2023, the company switched from being a LinkedIn competitor to offering a website creation service.The new pitch? 🤔

Turn your LinkedIn profile into a beautiful personal website with the help of AI.

In an attempt to find a more sustainable business model, this was a departure from the original vision that had excited early adopters and investors.

⦿ 2024

Despite the pivot, Polywork struggled to gain traction in either market. By late 2024, reports of its impending shutdown began circulating, signaling the end of its journey as a viable business.

⦿ 2025

Polywork officially announced its closure in January, marking the conclusion of its operations.

📉 Where Did Polywork Go Wrong?

Now that we've set the stage, let's break down some of the key factors that contributed to Polywork's downfall:

1️⃣ Underestimating the network effect

What happened: Building a social network from scratch is incredibly challenging. Polywork struggled to achieve the critical mass of users necessary to create a vibrant, self-sustaining network.

Lesson for PMs: When building a product that relies on network effects, have a clear strategy for overcoming the “cold start” problem.

💡 The cold start problem refers to the initial difficulty of launching a platform or product that depends on having a large number of active users to provide value. It’s a classic chicken-and-egg scenario:

🐣 Users won’t join a platform if there’s no valuable content or interactions.

🐓 But content and interactions cannot exist without users.

This problem is particularly a big deal for:

📷 Social networks

🏪 Marketplaces

👩❤️👨 Dating apps

📝 Content platforms

👤 And any product where the value increases with more users

2️⃣ Lack of clear differentiation

What happened: Despite innovative features, Polywork struggled to articulate why users should choose it over LinkedIn or maintain profiles on both platforms.

Lesson for PMs: Unique features aren’t enough; your product needs a clear, compelling value proposition that addresses a significant pain point.

3️⃣ Pivot confusion

What happened: The shift to a website builder service, while potentially necessary for survival (?), likely confused and alienated early adopters who had bought into the original vision.

Lesson for PMs: While pivots can be necessary, they need to be executed carefully to maintain user trust and engagement.

4️⃣ Funding pressure

What happened: With $13 million in funding, there was likely pressure to show rapid growth, potentially leading to unsustainable user acquisition strategies.

Lesson for PMs: Resist the temptation to scale prematurely. Focus on product-market fit before aggressive expansion.

5️⃣ Market timing

What happened: Polywork launched during a period of "tech fatigue" when users were becoming more selective about adopting new platforms. This made user acquisition even more challenging.

Lesson for PMs: Thoroughly assess market conditions and competition before committing significant resources to a new product.

Lessons for Building Long-Term Success

Now that we have completed our deep dive into the Polywork journey, what can we, as product managers, learn from them?

1. Validate your market ruthlessly

Before investing heavily in building a product, especially in a crowded space, ensure there's a genuine, unmet need. Conduct thorough user research and be brutally honest about the size and accessibility of your target market.

💡 Pro tip: Don't just listen to early enthusiasts. Seek out skeptics and understand their reservations. Their insights can be invaluable in refining your product strategy.

2. Have a clear differentiation strategy

If you're entering a market with established players, your unique value proposition needs to be crystal clear and compelling. "Better design" or "more features" often isn't enough to overcome the gravitational pull of existing networks.

💡 Pro tip: Conduct regular “pre-mortems”. Imagine your product has failed and work backward to identify potential causes. This exercise can help you proactively address weaknesses.

3. Be prepared for the long haul

Building a successful product, especially a social platform, takes time. Ensure you have the runway (both financially and in terms of team motivation) to weather the inevitable challenges and slow initial growth.

💡 Pro tip: Establish clear success metrics. Define what success looks like at each stage of your product’s lifecycle, from MVP to mature product.

You can also develop contingency plans for different growth trajectories and market conditions.

4. Listen to your users, but don't lose sight of your vision

While pivots can be necessary, dramatic shifts in product direction can alienate your core user base. If you do need to pivot, make sure you're bringing your community along for the ride through clear communication and by preserving the elements they loved about your original product.

💡 Pro tip: As you iterate and add features, always tie changes back to your core value proposition.

Easier said than done, right?

Of course, these are some of the things I came up with while researching their case. But I want to make it clear that writing this use case was much easier than being in their shoes with a lot of pressure and setbacks.

Final Thoughts

Polywork’s story reminds us that in the world of product development, there are no guarantees. Even with innovative ideas, strong backing, and initial buzz, success is never assured. But that’s what makes our role as product managers so exciting and challenging.

Although Polywork's journey comes to an end, the lessons it leaves behind are invaluable. I believe that the team behind Polywork has undoubtedly gained valuable knowledge that will serve as a foundation for their future projects. Wish them all the best in their next builds. 🚀

What are your thoughts on Polywork's story? Have you faced similar challenges in your own product development journey? Share your experiences and insights in the comments below. 👇

Great analysis, Elena. I used it the first months, I liked it. Then, it was weird but somehow interesting when they turned into a website builder... At the end of the day, people don't want many websites or portfolios to visit just a standardized view in a trusty place so they can see if they want to do business or not with someone... So, I think they misread the correct value proposition to compete.

They never provided sufficient additional value over LinkedIn. Even if they had became a strong competitor, it would be easy for LinkedIn to copy their few benefits.